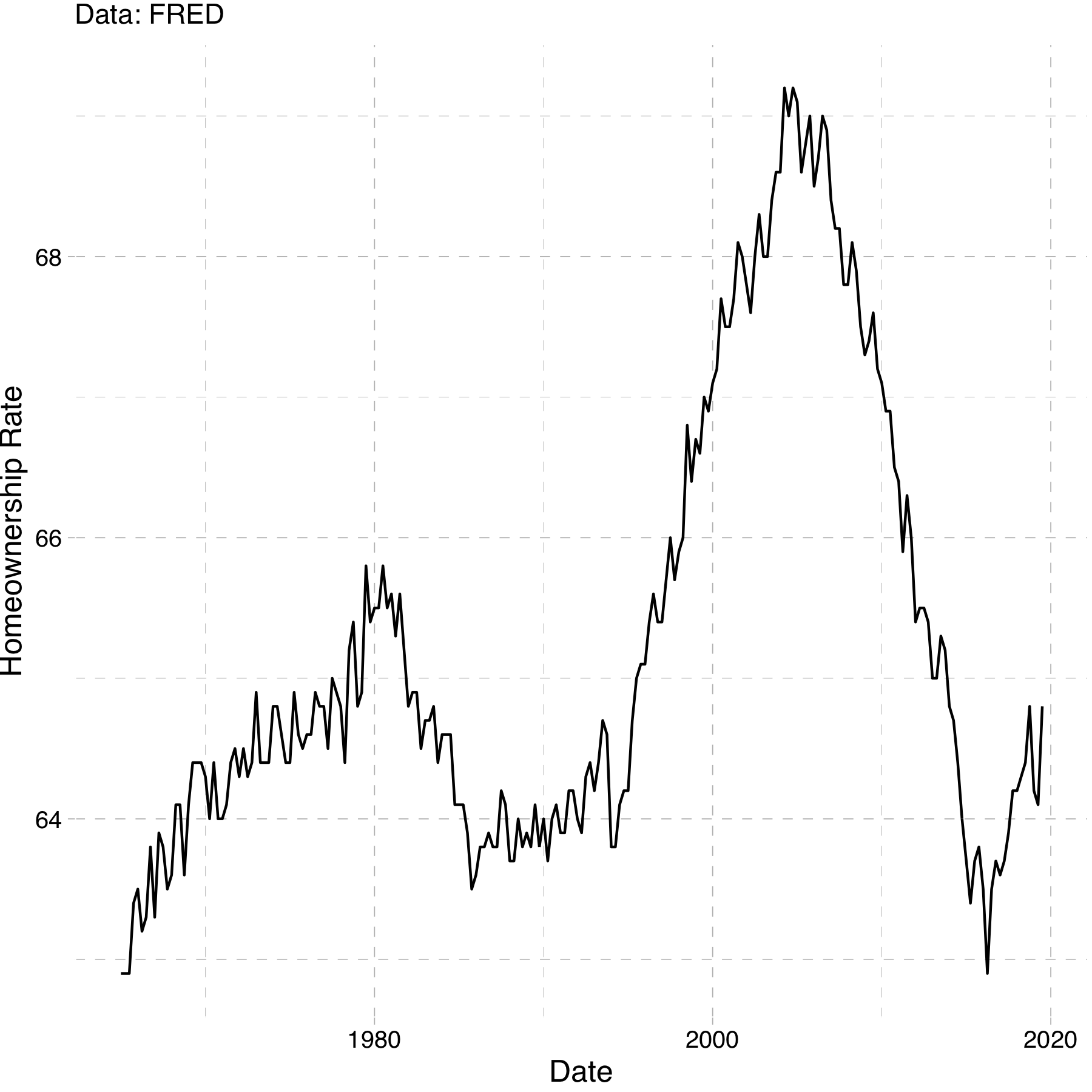

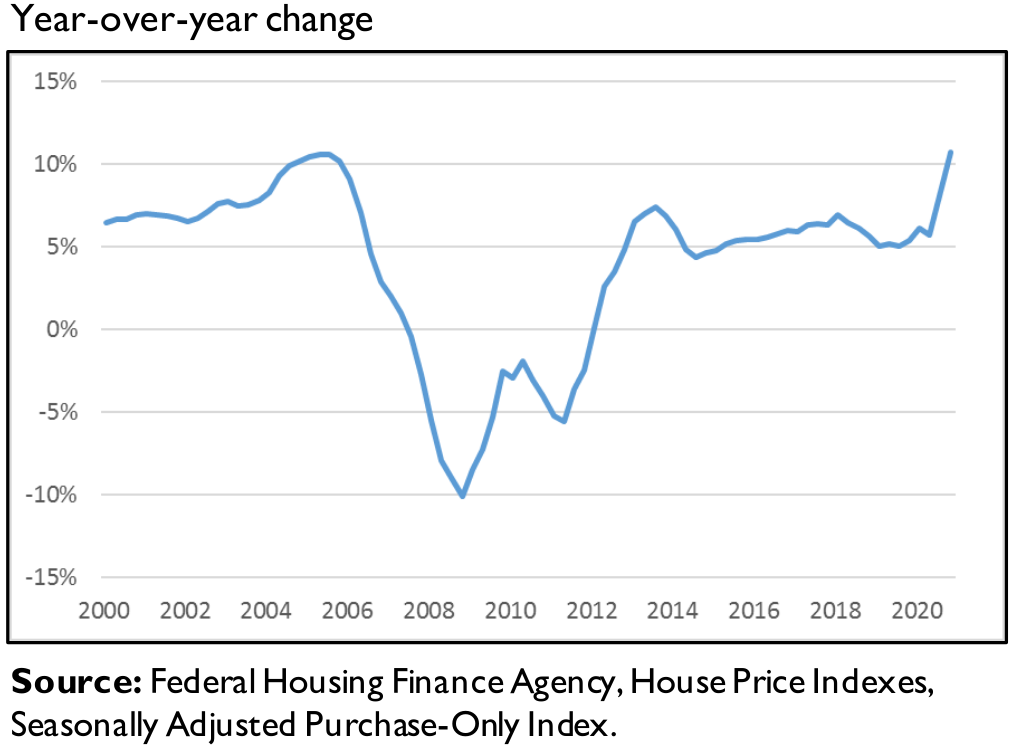

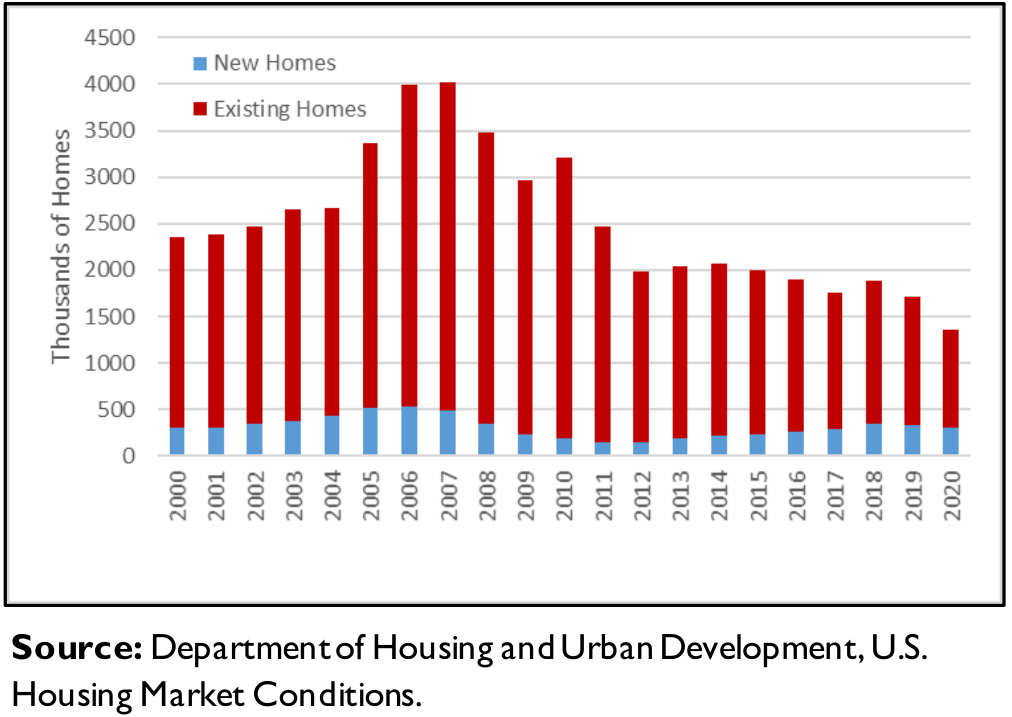

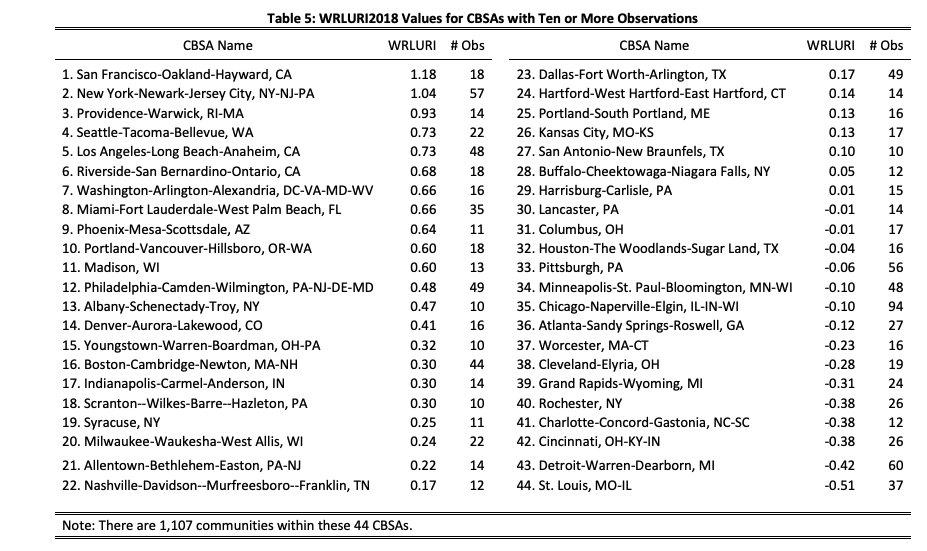

class: center, middle, inverse, title-slide .title[ # Housing ] .subtitle[ ## Set 10 ] .author[ ### Andrew Dickinson ] .date[ ### Fall 2022 ] --- class: inverse, middle # Content .hi-white[(i) Homeownership] .hi-white[(ii) Rental markets] --- # Housekeeping .pull-left[ .hi[PS03] _(due Friday, Nov. 25)_ - Posted now (a couple of minutes ago) ] .pull-right[ .hi[PS04] _(due Wed, Nov. 30)_ - will be posted by Mon next week ] -- .hi[TotC book report] _(due Thu, Dec. 8)_ - Short (1000 words) assignment - rubric posted on canvas and on the course repo - will be checking for plagiarism -- .hi-red[Final] _(14:45 Wed, Dec. 7)_ - [final schedule](https://registrar.uoregon.edu/calendars/examinations) - Comprehensive exam with an emphasis on the newer material --- class: inverse, middle # Housing markets --- # Housing markets Distinguish the following two markets: - .hi[Rental Market:] Supply and Demand for rentals - .hii[Housing Market:] Supply and Demand for houses <br> -- <br> _Why is it important to distinguish these?_ - A house is an asset. A month of rent is not - Homeowners are much less mobile than renters --- # Homeownership Following the great depression the .hi[New Deal] stimulated private homeownership by making it easier for individuals to buy and sell houses - established the .hi[Federal Housing Administration] and the .hi[Home Owners Loan Corporation] -- The Federal Government .hi[invented] the modern home mortgage by .hii[insuring] private home loans Which .hi[incentivised] banks to accept: - .hi-red[smaller] down payments - .hi-red[lower] interest rates - .hi-blue[longer] term loans (15/30 year mortgage) -- Allowed citizens to buy homes that they otherwise would not have afforded, establishing cycles of .hi[generational wealth] --- # Homeownership _Why is buying a home different than buying a pair of jeans?_ -- Houses are a major investment and store of value (.hi[equity]) -- Homeownership remains a .hi[key] component of household wealth - The value is subject to some uncertainty -- <br> Purchasing a home is a .hi[dynamic] (forward-looking) decision Jeans (a pure consumption good) is not really a store of value -- We will focus on the rental market. -- But first some data. --- class: clear # Rentals vs Homeowners .center[  ] -- .smallerer[Why such a big spike?] --- # Housing prices (nominal) .center[  ] --- # Housing inventory .center[  ] --- # Housing crisis (summarized) .center[.hi[What caused the housing market crash in 2007?]] -- .center[.hii[Among many other things, subprime mortgages]] -- Historically, mortgage loans were a safe investment as defaulting was rare -- Mortgages are typically bundled together with lots of other home loans and sold on a marketplace better banks -- Due to growing home prices in the US housing market, these ".hi[securities]" were desirable and had higher returns than US treasury bonds and were in high demand. Lenders tried to keep up. -- Mortgage lenders took too much risk by extending loans the millions of Americans who could not afford them --- # Housing crisis (summarized) These high risk, subprime loans were bundled into .hi[securities] with lower risk loans and sold them to banks -- Rating agencies didn't fully understand the extent to which lenders were extending subprime loans and granted high grades (AAA) -- Then the housing bubble popped, and high interest rates set in on adjustable loans, massive amounts of people defaulted -- People shorted the banks on their investments and it lead to a massive financial crisis --- class: inverse, middle # Rental markets --- # Rental market model Just like labor markets, each city has its own market for rental units - Consists of suppliers (absentee landlords) - Individuals making optimal housing demand decisions -- .hi[Important:] Firms (landlords) supply housing to households -- .hi[Assumptions:] -- .hii[(i)] No individual landlord can influence the price of rents -- .hii[(ii)] Landlords decide how much housing to provide -- .hii[(iii)] The amount of housing they provide will again come from profit maximization --- # Rental market model: Perf Comp Profit function given by: `\begin{align*} \pi(Q) = P*Q - TC(Q) \end{align*}` -- .hi[Note:] Now cost is a function of quantity -- Implicitly we are assuming that at any quantity, the firm will use the optimal level of labor and capital -- Marginal profit equals zero , `\(\frac{\Delta \pi(Q)}{\Delta Q}= 0\)`: -- `\begin{align*} \frac{P*\Delta Q}{\Delta Q} - \frac{\Delta TC(Q)}{\Delta Q} = 0 \end{align*}` --- count: false # Rental market model: Perf Comp Profit function given by: `\begin{align*} \pi(Q) = P*Q - TC(Q) \end{align*}` .hi[Note:] Now cost is a function of quantity Implicitly we are assuming that at any quantity, the firm will use the optimal level of labor and capital Marginal profit equals zero , `\(\frac{\Delta \pi(Q)}{\Delta Q}= 0\)`: `\begin{align*} \frac{P*\Delta Q}{\Delta Q} - \frac{\Delta TC(Q)}{\Delta Q} &= 0\\ P &= \frac{\Delta TC(Q)}{\Delta Q} \end{align*}` --- count: false # Rental market model: Perf Comp Profit function given by: `\begin{align*} \pi(Q) = P*Q - TC(Q) \end{align*}` .hi[Note:] Now cost is a function of quantity Implicitly we are assuming that at any quantity, the firm will use the optimal level of labor and capital Marginal profit equals zero , `\(\frac{\Delta \pi(Q)}{\Delta Q}= 0\)`: `\begin{align*} \frac{P*\Delta Q}{\Delta Q} - \frac{\Delta TC(Q)}{\Delta Q} &= 0\\ P &= \frac{\Delta TC(Q)}{\Delta Q}\\ P &= MC(Q) \end{align*}` --- count: false # Rental market model: Perf Comp Profit function given by: `\begin{align*} \pi(Q) = P*Q - TC(Q) \end{align*}` .hi[Note:] Now cost is a function of quantity Implicitly we are assuming that at any quantity, the firm will use the optimal level of labor and capital Marginal profit equals zero , `\(\frac{\Delta \pi(Q)}{\Delta Q}= 0\)`: `\begin{align*} \frac{P*\Delta Q}{\Delta Q} - \frac{\Delta TC(Q)}{\Delta Q} &= 0\\ P &= \frac{\Delta TC(Q)}{\Delta Q}\\ P &= MC(Q) \end{align*}` .center[.hi[Increasing marginal costs leads to upward sloping supply curves!]] --- class: inverse, middle # Monopoly --- # Rental market model: Monopoly Now let's consider the .hi[monopoly] situation: -- .hi[Assume:] -- .hii[(i)] One seller of the good (rental units) -- .hii[(ii)] The monopolist has market power; ability to set prices -- .hii[(iii)] The monopolist is a profit maximizer --- # Rental market model: Monopoly Equilibrium relies on the assumption that firms maximize profits -- Now TR is a function of quantity `\begin{equation*} TR = P(Q)*Q \end{equation*}` -- Quantity of houses that the monopolist produces changes the market price -- `\(P(Q)\)` in this context is called the inverse demand function -- .hi[Profit is given by:] `\begin{align*} \pi(Q) = P(Q)*Q - TC(Q) \end{align*}` --- # Rental market model: Monopoly Profit Maximization gives us the familiar `\(\frac{\Delta \pi(Q)}{\Delta Q} = 0\)` -- `\begin{align*} \frac{\Delta P(Q)*Q}{\Delta Q} - \frac{\Delta TC(Q)}{\Delta Q} = 0 \end{align*}` --- count: false # Rental market model: Monopoly Profit Maximization gives us the familiar `\(\frac{\Delta \pi(Q)}{\Delta Q} = 0\)` `\begin{align*} \frac{\Delta P(Q)*Q}{\Delta Q} - \frac{\Delta TC(Q)}{\Delta Q} &= 0 \\ MR(Q) &= MC(Q) \end{align*}` -- .hi[Note:] Now, `\(\frac{\Delta P(Q)*Q}{\Delta Q} \neq P\)`. --- # Simple monopoly example --- # Monopoly Graph -- <img src="10-housing_files/figure-html/m1-1.svg" style="display: block; margin: auto;" /> --- count: false # Monopoly Graph <img src="10-housing_files/figure-html/m2-1.svg" style="display: block; margin: auto;" /> --- count: false # Monopoly Graph <img src="10-housing_files/figure-html/m3-1.svg" style="display: block; margin: auto;" /> --- class: inverse, middle # Rental markets across cities --- # Rents across cities .hi[Key question:] What causes rental curves to vary across cities? -- Supply curves across cities are impacted by: - .hi-blue[local construction costs] - .hi-green[limited land availability] (for development) - .hi-green[land-use regulations] -- .hi-blue[Local construction costs]: shifts supply curve (labor is more expensive for all firms in one area vs another) -- .hi-green[Land availability] + .hi-green[land use regulations:] rotates supply curve (changes in the marginal cost of developing land) --- # Rents across cities _Why do changes in local constructions costs shift the supply curve when land use regulations rotate it?_ -- .hi[Answer:] Changes in .hi-blue[construction costs] impact all development equally. - if wood becomes more expensive then every project becomes equally more expensive across the city Changes in .hi-green[land availability] or .hi-green[land-use regulations] increase the .hii[opportunity cost] of developing additional plots of land - prices bid faster for each additional development --- # Urban Housing Supply Curves <img src="10-housing_files/figure-html/supply1-1.svg" style="display: block; margin: auto;" /> --- count: false # Urban Housing Supply Curves <img src="10-housing_files/figure-html/supply2-1.svg" style="display: block; margin: auto;" /> .hii[purple:] lower construction cost (lower intercept) --- count: false # Urban Housing Supply Curves <img src="10-housing_files/figure-html/supply3-1.svg" style="display: block; margin: auto;" /> .hi-green[green:] higher .green[land-use regulations] <!-- --- --> <!-- class: inverse, middle --> <!-- # Rental markets --> <!-- .hi-white[We will focus on .hii[two] policies:] --> <!-- .hi-white[(i) Rent Control] --> <!-- .hi-white[(ii) Land-use restrictions] --> --- class: inverse, middle # Rent control --- # Rent control .hi[Definition:] .hii[Rent Control] > A _price ceiling_ set on rental units -- > _Price Ceiling:_ Max allowed price on the market -- Brief History (US): - Started around WW1. Expanded during WWII -- - 1970: Nixon puts 90-day freeze on prices to combat inflation -- - _Mostly_ a .hi[place based policy]. - SF, NY, LA, Oakland, DC, Berkeley, West Hollywood - Oregon: first state to have state-wide rent control --- class: clear # Rent Control  --- # Rent Control in Oregon ### Senate Bill 608 2019: Oregon passes .hi[state-wide] rent control - limits annual increases to inflation (2-3%) + 7% - landlords can increase rent without limit for new tenants -- Also includes a series of eviction protections for renters --- class: inverse, middle # Land use restrictions --- # Land use restrictions Land use restrictions limit what one can do with available land. -- Examples: .hi[(i)] Density restrictions .hi[(ii)] Minimum lot sizes .hi[(iii)] Parking requirements .hi[(iv)] Sidewalk and street size requirements .hi[(v)] Height restrictions -- Not all of these are bad things. But they do make developing land more expensive. --- # Wharton Index  Higher values of the Wharton index `\(\implies\)` tighter land use restrictions --- # Example --- # A Model Do Land-Use regs and rent control interact? Absolutely! Let's model it -- `\begin{align*} P(Q_d) &= 20 - 2*Q_d\\ P(Q_s) &= 8 + Q_s\\ \end{align*}` Compute the equilibrium. Graph it, if that is helpful -- - Now suppose the government ratchets up land-use regs. New supply is given by: `\begin{align*} P(Q_s^{new}) = 8 + 2*Q_s^{new} \end{align*}` --- # Example Old eq: `\(Q^* = 4\)`, `\(P^* = 12\)` New eq: `\(Q^* = 3\)`, `\(P^* = 15\)` Government comes in and says the rents are too high. Rent control set at `\(12\)` per unit. Now you have: `\begin{align*} 12 = 8+2*Q_s \implies Q_s = 2 \end{align*}` --- count: false # Example Old eq: `\(Q^* = 4\)`, `\(P^* = 12\)` New eq: `\(Q^* = 3\)`, `\(P^* = 15\)` Government comes in and says the rents are too high. Rent control set at `\(12\)` per unit. Now you have: `\begin{align*} 12 = 8+2*Q_s &\implies Q_s = 2\\ 12 = 20 - 2*Q_d &\implies Q_d = 4 \end{align*}` --- count: false # Example Old eq: `\(Q^* = 4\)`, `\(P^* = 12\)` New eq: `\(Q^* = 3\)`, `\(P^* = 15\)` Government comes in and says the rents are too high. Rent control set at `\(12\)` per unit. Now you have: `\begin{align*} 12 = 8+2*Q_s &\implies Q_s = 2\\ 12 = 20 - 2*Q_d &\implies Q_d = 4 \end{align*}` So we have a .pink[shortage] of two units at the .hi.purple[old] equilibrium price. 😧 --- # A Note We wont have time (but it might be good practice) for you to think through what would happen if the market was a .hi[monopoly] - Similar to the .hi.purple[monopsonist], rent control can actually .pink[lower prices] in a completely .purple[monopolized] housing market Let's take a (quick) look at some recent empirical evidence --- # Empirics [Diamond et. al (2019)](https://web.stanford.edu/~diamondr/DMQ.pdf) - 1979: Rent control in SF put in place for all standing buildings with 5 apartments or more - New buildings exempt (to promote developers to continue building) - Small multi-family apartment buildings ("mom & pop") exempted - 1994: Exemption for small multi-family buildings removed. All apartments .hi[built before 1980] subject to rent control --- # Empirics In this study: - .hi[Treatment:] Those living in small apartment complexes (5 or less) built in 1979 or before - .hi[Control:] Those living in small apartments complexes (5 or less) built after 1979 (not subject to rent control) -- A fair comparison? Maybe concerned that those living in apartments built before or after 1979 are systematically different. .hi.slate[Main Findings]: .hi[(i)] Reduced renter mobility by ~20% .hi[(ii)] Reduced housing supply by about 15% <!-- --- --> <!-- exclude: true --> <!-- ```{R, generate pdfs, include = F} --> <!-- system("decktape remark 02_goodsmarket_part1.html 02_goodsmarket_part1.pdf --chrome-arg=--allow-file-access-from-files") --> <!-- ``` -->