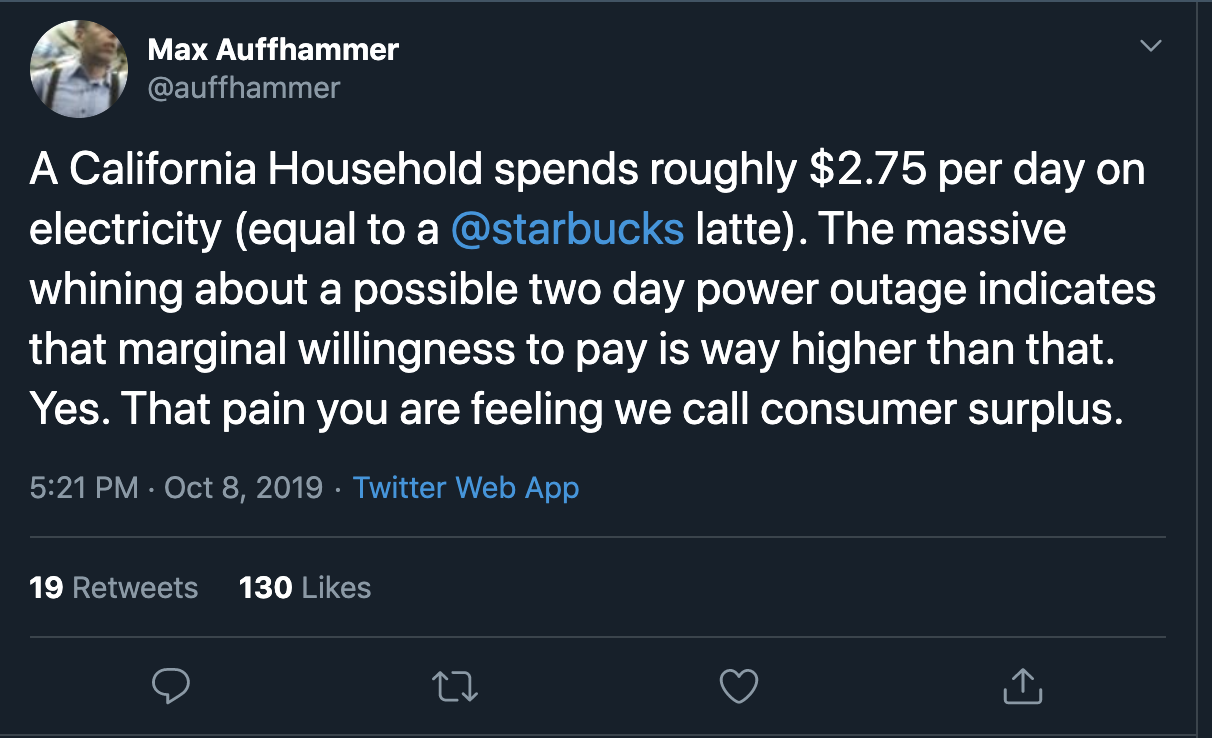

class: center, middle, inverse, title-slide # Econ 330: Urban Economics ## Lecture 02 ### Andrew Dickinson ### 07 October, 2021 --- class: inverse, center, middle # Lecture 02: Review & The 5 Axioms of Urban Economics --- class: inverse name: schedule # Schedule .pull-left[ .ul[.bigger[.hi-white[Today:]]] .hi-white[(i). EC-201 review] .hi-white[(ii). The five axioms of urban econ] ] -- .pull-right[ .ul[.bigger[.hi-white[Upcoming:]]] - .hi-white[EC-201 Review Quiz on Canvas] - .hi-white[Letter of Intro on Canvas] - [Reading:](https://rawcdn.githack.com/ajdickinson/ec330-summer21/db71091164ea554b0bb7c7bb90528ece563e0bac/resources/Triumph-of-the-City-Edward-Glaeser.pdf) intro + chapter 1 ] --- class: inverse, middle name: ec201_review # Review Resources for more EC-201 review: [Khan academy](https://www.khanacademy.org/economics-finance-domain/microeconomics/basic-economic-concepts-gen-micro#economics-introduction) --- name:demand # Review 011: Demand .hi[Definition:] The relationship between prices and quantities (demanded) -- .pull-left[ .hi[The Law of Demand] - `\(P \uparrow \longrightarrow Q_d \downarrow\)` - When prices increase, quantity demanded decreases <br> The key players are .hii[consumers] ] -- .pull-right[ .hi-orange[Example:] Demand schedule <table class="table" style="font-size: 18px; margin-left: auto; margin-right: auto;"> <thead> <tr> <th style="text-align:left;"> Price </th> <th style="text-align:center;"> Quantity </th> </tr> </thead> <tbody> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 2 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 1000 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 4 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 750 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 6 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 500 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 8 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 250 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 10 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 0 </td> </tr> </tbody> </table> ] -- - .hi[Demand curves] are constructed from .hi[consumers] making optimal purchase decisions --- # Review 011: Demand <img src="02-review_files/figure-html/plot01-1.png" style="display: block; margin: auto;" /> -- Movement vs shift in demand --- # Review 011: Demand <img src="02-review_files/figure-html/plot01b-1.png" style="display: block; margin: auto;" /> --- # Review 012: Supply .hi[Definition:] The relationship between prices and quanitities (supplied) -- .pull-left[ .hi[The Law of Supply:] - When prices increase, the quantity supplied increases - `\(P \uparrow \longrightarrow Q_s \uparrow\)` <br> The key players are .hi[firms] ] -- .pull-right[ .hii[Example:] Supply schedule <table class="table" style="font-size: 18px; margin-left: auto; margin-right: auto;"> <thead> <tr> <th style="text-align:left;"> Price </th> <th style="text-align:center;"> Quantity </th> </tr> </thead> <tbody> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 2 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 250 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 4 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 500 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 6 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 750 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 8 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 1000 </td> </tr> <tr> <td style="text-align:left;color: #314f4f !important;background-color: white !important;"> 10 </td> <td style="text-align:center;color: #314f4f !important;background-color: white !important;"> 1250 </td> </tr> </tbody> </table> ] -- .hi[Supply curves] are constructed from .hii[producers] making optimal production decisions --- # Review 012: Supply .center[ <img src="02-review_files/figure-html/plot02a-1.png" style="display: block; margin: auto;" /> ] -- Movement vs shift in demand --- # Review 012: Supply .center[ <img src="02-review_files/figure-html/plot02b-1.png" style="display: block; margin: auto;" /> ] --- # Review 013: Equilibrium + surplus .ul[.hi[Definitions:]] -- - .hi[Equilibrium:] A pair of points `\((Q*,P*)\)` such that there is no excess supply or demand - Supply = Demand - .ul[.blue[Fundamental Assumptions:]] Marginal value (utility) is decreasing and marginal cost is increasing -- - .hi[Consumer Surplus:] The difference between a consumers .hi-gold[maximum] willingness to pay (WTP) and the market price -- - .hi[Producer Surplus:] The difference between the price producers .hii[minimum] willingness to sell and the market price --- # Review 013: Market equilibrium `\begin{align*} Q = 1250 - 125*P \\ Q = 125*P \end{align*}` -- .center[ <img src="02-review_files/figure-html/plot03-1.png" style="display: block; margin: auto;" /> ] --- # Review 013: Market equilibrium shifts --- # Example: Consumer surplus --  Source: [@auffhammer](https://twitter.com/auffhammer) --- # Example: Solve for the equilibrium .hi[Example] Suppose we are given the following: - Supply: `\(\color{#e64173} {P(Q_s) = 10 + Q_s}\)` - Demand: `\(\color{#6A5ACD} {P(Q_d) = 20 - 4*Q_d}\)` -- .hi[Task:] .hii[(i).] Carefully graph and label both curves .hii[(ii).] Compute the Equilibrium .hii[(iii).] Compute Consumer and Producer Surplus --- # Example: Solve for the equilibrium - Supply: `\(\color{#e64173} {P(Q_s) = 10 + Q_s}\)` - Demand: `\(\color{#6A5ACD} {P(Q_d) = 20 - 4*Q_d}\)` -- <img src="02-review_files/figure-html/supply_demand-1.svg" style="display: block; margin: auto;" /> --- # Example: Solve for the equilibrium - .hi[Equilibrium]: `\begin{align*} 10 + Q^\star &= 20 - 4*Q^\star\\ 5Q^\star &= 10\\ Q^\star &= 2 \end{align*}` Plug this into either supply or demand equation to get: `\begin{align*} P^\star = 10 + 2 = 12 \end{align*}` -- - .hi[Consumer Surplus]: - `\(CS= \frac{1}{2}*(20-12)*(2-0) = 8\)` -- - .hi[Producer Surplus]: - `\(PS = \frac{1}{2}*(12-10)(2-0) = 2\)` --- # Example: Using the follow supply + demand functions .hii[Supply:] `\(Q(p_s) = -15 + \frac{3}{5} * p_s\)` .hi[Demand:] `\(Q(p_d) = 45 - \frac{2}{5} * p_d\)` Determine: - (i) Graph each curve and label carefully - (ii). Equilibrium prices ( `\(p^*\)` ) and quantities ( `\(q^*\)` ) - (iii). Consumer surplus - (iv). Producer surplus --- name: elasticites # Review 014: Elasticities .hi[Elasticity:] A measure of responsiveness of one variable to another - .hii[in percentage terms] -- .hi[Common elasticities:] -- - .hi[Own price elasticity (good x)]: Measures how much quantity demanded for .hi[x] will respond to a one percent change in the price of good .hi[x] - Formula: `\(\varepsilon_{x, P_x} = \frac{\%\Delta Q_x}{\%\Delta P_x}\)` -- - .hi[Cross price elasticity (goods x,y)]: Measures how much quantity demanded for .hi[x] will respond to a one percent change in the price of .hii[y] - Formula: `\(\varepsilon_{x,P_y} = \frac{\%\Delta Q_x}{\%\Delta P_y}\)` --- # Review 014: Elasticities (examples) Own price elasticity: -- Cross price elasticity: --- # Review 014: Elasticities Suppose `\(\varepsilon_{x, P_x}= -0.5\)`. What does this mean in words? -- A 1% change in the .hi[price of good x] will lead to a .5% change in the _opposite_ direction in the .hi[quantity demanded for good x] -- The equation can be helpful. If `\(\varepsilon_{x, P_x}= -0.5\)`, then: `\begin{align*} \frac{\%\Delta Q_x}{\%\Delta P_x}&= -0.5\\ \%\Delta Q_x &= -0.5 * \%\Delta P_x \end{align*}` --- exclude: false # Review 014: Elasticities (questions) .hi[Review Questions:] - If `\(\varepsilon_{x,y}>0\)`, are these goods complements or substitutes? -- - Substitutes, because an increase in the price of `\(y\)` .hi[increases] demand for `\(x\)` - Lame example: cheerios and other cereal -- - If `\(\varepsilon_{x,y}<0\)`, are these goods complements or substitutes? -- - Complements, because an increase in the price of `\(y\)` .hi[decreases] demand for `\(x\)` - Lame example: Left and right shoes; pb and bananas --- name:profit # Review 015: Cost functions .ul[.hi[Defintions:]] - .hi[Total Revenue (TR)]: Total money firm brings in from selling `\(Q\)` units. - `\(TR = P*Q\)` -- - .hi[Total Cost (TC)]: The cost of producing `\(Q\)` units units -- - .hi[Average Cost (AC)] = `\(\frac{TC}{Q}\)` -- - .hi[Profit] (denoted as `\(\Pi\)`): `\begin{equation} \Pi = TR-TC \end{equation}` --- # Review 015: Cost functions Suppose the price of the output good is `\(3\)` dollars per unit. Suppose a firm's cost function is `\(TC(Q) = 1+Q\)`. If the firm produces 8 units of the good, calculate: - `\(TR\)` - `\(TC\)` - `\(AC\)` - `\(\Pi\)` (profit) --- # Review 015: Cost functions Suppose the price of the output good is `\(3\)` dollars per unit. Suppose a firm's cost function is `\(TC(Q) = 1+Q\)`. If the firm produces 8 units of the good, calculate: - `\(TR = 3*8 = 24\)` - `\(TC = 1 + 8 = 9\)` - `\(AC = \frac{9}{8}\)` - `\(\Pi = 24 - 9 = 15\)` --- name:utility # Review 016: Utility .ul[.hi[Definitions:]] - .hi[Utility:] Satisfaction one receives from consuming a good or a service - Ordinal not cardinal; only know order of preference not how much -- - .hi[Utility function:] `\(U(x)\)` A function that describes utility given from `\(x\)` -- - .hi[Marginal Utility:] Additional utility received from one additional good -- - .hi[The Law of Diminishing Marginal Utility:] Marginal utility decreases as one consumes more and more goods or services --- class: inverse, center, middle name:axioms # The Five Axioms of Urban Economics --- # The Five Axioms of Urban Economics As discussed in [lecture 01](https://rawcdn.githack.com/ajdickinson/ec330-summer21/a75becc5e8f60e4d338d1a81d452b5fd09c2a905/slides/001-intro/01-intro.html), we are after some big questions in this course - Agree upon a few basics before moving onto more complex problems -- .hi[.ul[Definition:] Axiom] - A statement which is regarded as being established or evidently true - Long agreed upon assumptions -- Axioms are the building blocks upon which theory is built -- The 5 axioms of urban econ are 5 assumptions that we will take _as given_ throughout the class - Almost everything moving forward will be tied to one of these assumptions --- # The Five Axioms of Urban Economics Some lectures will focus on refining our understanding of these axioms -- Almost everything we learn ties back to one of the 5 axioms -- .ul[.hi[(A1).]] Prices adjust to acheive locational equilibrium .ul[.hi[(A2).]] Self-reinforcing effects generate extreme outcomes .ul[.hi[(A3).]] Externalities are inefficient .ul[.hi[(A4).]] Production is subject to economies of scale .ul[.hi[(A5).]] Competition generates zero economic profit --- class: hide-count # The Five Axioms of Urban Economics Some lectures will focus on refining our understanding of these axioms Almost everything we learn ties back to one of the 5 axioms .ul[.hi[(A1).]] .hi[Prices adjust to acheive locational equilibrium] .ul[.hi[(A2).]] Self-reinforcing effects generate extreme outcomes .ul[.hi[(A3).]] Externalities are inefficient .ul[.hi[(A4).]] Production is subject to economies of scale .ul[.hi[(A5).]] Competition generates zero economic profit --- name:axiom_1 #Axiom 1 .hi[A1]: _Prices adjust to acheive .hi[locational equilibrium]_ <sup>.hi[†]</sup> .footnote[.hi[†]: We will refine this definition later in the term] -- - .hi[Locational EQ]: The balance that exists when there is no incentive for firms or households to move -- .hi[Prices] must adjust s.t. there is indifference between locations `\(\implies\)` No incentive exists -- .hi[Examples:] -- - Rents .hi[near] downtown > rents .hii[far] from downtown - Home prices .hi[near] good schools > home prices .hii[near] bad schools - Wages in .hi[high-cost] cities > wages in .hii[low-cost] cities - Amenities in .hi[high-cost] cities > amenities in .hii[low-cost] cities --- class: hide-count # The Five Axioms of Urban Economics Some lectures will focus on refining our understanding of these axioms Almost everything we learn ties back to one of the 5 axioms .ul[.hi[(A1).]] Prices adjust to acheive locational equilibrium .ul[.hi[(A2).]] .hi[Self-reinforcing effects generate extreme outcomes] .ul[.hi[(A3).]] Externalities are inefficient .ul[.hi[(A4).]] Production is subject to economies of scale .ul[.hi[(A5).]] Competition generates zero economic profit --- name:axiom_2 #Axiom 2 .hi[A2:] _.hi[Self-reinforcing effects] generate extreme outcomes_ .hi[Self-reinforcing effect]: Pattern that leads to changes in the same direction - AKA _positive feedback loop_ -- .hi[Examples] -- - Tech firms in the Silicon Valley -- - Artists in Santa Fe, NM -- - Hippies in Eugene, OR -- Explains common pattern of clustering of similar people and firms --- class: hide-count # The Five Axioms of Urban Economics Some lectures will focus on refining our understanding of these axioms Almost everything we learn ties back to one of the 5 axioms .ul[.hi[(A1).]] Prices adjust to acheive locational equilibrium .ul[.hi[(A2).]] Self-reinforcing effects generate extreme outcomes .ul[.hi[(A3).]] .hi[Externalities are inefficient] .ul[.hi[(A4).]] Production is subject to economies of scale .ul[.hi[(A5).]] Competition generates zero economic profit --- name:axiom_3 # Axiom 3 .hi[A3:] _.hi[Externalities] are inefficient_ .hi[Externality]: A .hii[cost] or .hi[benefit] of a transaction experienced by somebody who is not involved in the transaction -- .hii[Negative Externalities] (costs) .pull-left[ - Pollution - [Car noise](https://www.youtube.com/watch?v=Wy4ZK4qBUrI)] .pull-right[ - Dilapidated housing - Second-hand smoke] -- .hi[Positive Externalities] (benefits) .pull-left[ - Vaccines - Public schools] .pull-right[ - Remodeling housing - Beekeepers] --- # Axiom 3: Externalities -- What do these have to do with .hi[efficiency]?<sup>.hi[†]</sup> - Private incentives are not aligned with social costs or benefits .footnote[.hi[†]: Highest total surplus] -- - .hi[Example:] In absence of quotas, do people fish too much or too little? -- - Too much. This harms future fisheries -- Negative externalities are .hii[overprovided] Positive externalities are .hi[underprovided] - So a market with an externality is .hi[inefficient] --- class: hide-count # The Five Axioms of Urban Economics Some lectures will focus on refining our understanding of these axioms Almost everything we learn ties back to one of the 5 axioms .ul[.hi[(A1).]] Prices adjust to acheive locational equilibrium .ul[.hi[(A2).]] Self-reinforcing effects generate extreme outcomes .ul[.hi[(A3).]] Externalities are inefficient .ul[.hi[(A4).]] .hi[Production is subject to economies of scale] .ul[.hi[(A5).]] Competition generates zero economic profit --- name:axiom_4 #Axiom 4 .hi[14]: _Production is subject to .hi[economies of scale]_ -- .hi[Economies of Scale]: Average cost of production decreases as quantity produced increases - .hii["Lumpy" inputs:] Capital inputs may be indivisible; cannot scale down - .hii[Factor specialization:] Larger operations have more employees who then can specialize -- .hi[Examples:] -- .pull-left[ - Transportation of goods - Pizza ovens] .pull-right[ - Education - Building CPU] --- class: hide-count # The Five Axioms of Urban Economics Some lectures will focus on refining our understanding of these axioms Almost everything we learn ties back to one of the 5 axioms .ul[.hi[(A1).]] Prices adjust to acheive locational equilibrium .ul[.hi[(A2).]] Self-reinforcing effects generate extreme outcomes .ul[.hi[(A3).]] Externalities are inefficient .ul[.hi[(A4).]] Production is subject to economies of scale .ul[.hi[(A5).]] .hi[Competition generates zero economic profit] --- name:axiom_5 #Axiom 5 .hi[A5:] _Competition generates zero .hi[economic profit]_ -- - Degree of competition dictates .hi[number of firms] in the market - Firms enter (drives price down) until .hi[economic profit] `\(\rightarrow\)` zero - Enough firms earn enough to stay in business but no more -- .hi[Economic profit]: Includes .hi[oppurtunity cost] - Different from accounting profit; hear on the news/balance sheets -- <br> .hi[Eugene example:] Marijuana dispensaries --- # List of the 5 Axioms .ul[.hi[(A1).]] Prices adjust to acheive locational equilibrium .ul[.hi[(A2).]] Self-reinforcing effects generate extreme outcomes .ul[.hi[(A3).]] Externalities are inefficient .ul[.hi[(A4).]] Production is subject to economies of scale .ul[.hi[(A5).]] Competition generates zero economic profit --- class: inverse, middle # Schedule .pull-left[ .hi-white[Next Class]: - Determinants of city size] -- .pull-right[ .hi-white[Upcoming]: - [Reading:](https://rawcdn.githack.com/ajdickinson/ec330-summer21/db71091164ea554b0bb7c7bb90528ece563e0bac/resources/Triumph-of-the-City-Edward-Glaeser.pdf) intro + chapter 1] --- #Table of Contents .col-left[ ###Econ 201 Review .smallest[ 1. [Supply & Demand](#supply_demand) 1. [Elasticities](#elasticities) 1. [Profit, Revenue, & Cost](#profit) ] ] .col-right[ ###5 Axioms of Urban Economics .smallest[ 1. [Axiom 1: Prices adjust to acheive locational equilibrium](#axiom_1) 1. [Axiom 2: Self-reinforcing effects generate extreme outcomes](#axiom_2) 1. [Axiom 3: Externalities are Inefficient](#axiom_3) 1. [Axiom 4: Production is subject to economies of scale](#axiom_4) 1. [Axiom 5: Competition generates zero economic profit](#axiom_5) ] ]